I watch the Olympics and am in complete awe of the athletes, their incredible drive, commitment, and belief. Yes, the gold medal winners are of course simply amazing. I also like the stories of the athletes who achieve their personal best yet may still have only made the semi-final and don’t get the limelight so to speak. Their personal stories must also be amazing. Imagine all those hard years of training and doing a “PB” on that day. Wow, just incredible.

Just like the Olympics, Australia competes very well on the world stage when it comes to money.

For a start, we have one of the largest superannuation systems in the world. We are also one of the most educated nations, just like the Olympics on a per capita basis we compete very well on the global stage.

There is a big problem, a lot of the money in superannuation is invested well below world class standards.

Why does this matter?

Well number 1, this means there is no excuse to let your money be poorly managed.

As soon as you receive your first pay cheque, Australians become investors via our compulsory superannuation systems.

So, it’s important we learn about this superannuation system. It’s time that you make sure that “your money” works for “you”.

Just like our champion Olympians, a lot of hard work is required.

Managing money well does not happen overnight. A lot of things can get in the way that can detract from your performance.

So how do you become a “champion” investor?

How do you know where to find the right information and the best coach?

It is a process, and here are Arch Capital we have helped clients for over 20 years now leaning on an academic process that has been tested and trialled for over 50 years and shown to win.

Wouldn’t you prefer to work with an experienced coach using proven techniques?

Find out more at www.archcapital.com.au

Here is an excerpt from our book “The Super Secret” also available on our website.

Chapter 1. It’s Your Money, Manage It Well

“To invest successfully does not require a stratospheric IQ, unusual business insights, or inside information”, Warren Buffett says in the foreword to Benjamin Graham’sThe Intelligent Investor. “What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding the framework.”

All Australians are or will be investors. For many this is by default via your superannuation fund. Your compulsory savings of 9.5 percent of your salary are being invested by your superannuation fund in banks, mining, health care and infrastructure operations — roads, ports, airports, telecommunications and electricity distributors.

You may also become an investor by receiving an inheritance, buying a property or saving for a holiday.

You may dream about buying a boat, travelling the world or taking a cruise. All these goals require investing. The better an investor you are, the better your life will be.

Money is important to you for different reasons than to me, and we will all have different amounts of money at various times of our lives. How we manage this money to provide the outcomes we seek for ourselves and those we care about is very important.

While many people understand that their superannuation fund invests in shares, you may also have investments in bonds, cash, property and even private equity, options, and unlisted assets such as infrastructure. Many of these investments have names and descriptions you are not familiar with: terms like ‘dividend’, ‘yield’, ‘franking credit’, ‘hybrids’, ‘return of capital’, ‘return on equity’,’ capitalisation’, ‘Dow Jones’, ‘All Ordinaries’ mean absolutely nothing to many Australians. These mysterious terms and jargon have helped keep investment the domain of your investment managers, safe from you ever taking control or knowing enough to be sufficiently confident to make a change.

Do you really know what you are invested in? Do you really know what you should and, more importantly, what you should not be invested in?

You are not alone if you answered no. Very few people do know. Yet your superannuation and investments have the ability to enhance your life, to enable you to live your dreams and do the things you really want to do!

It is important you have the knowledge and skills to know if your money is being well managed, but it’s not a subject that is taught at school. Financial literacy in Australia is very low, despite our relatively high level of education.

As personal finance is not taught, it is no surprise that most investors make the same mistakes, such as trying to pick stocks or time markets, and try to buy in the lows and sell in the highs.

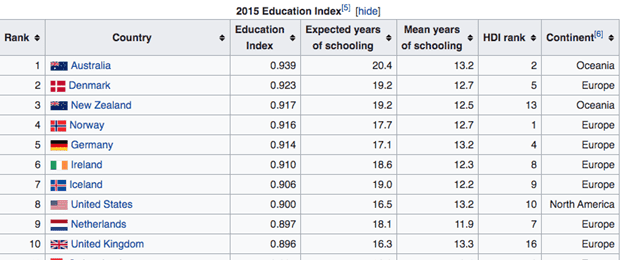

The Education Index, published with the UN’s Human Development Index in 2015, listed Australia as 0.939, the highest in the world. Since 2010, the Education Index has been measured by combining average adult years of schooling with expected years of schooling for children, each receiving 50 per cent weighting.

Do you really know how to invest? Do you have access to the truth about how markets work?

It is possible to demystify investing and demonstrate the truth so that you can have an investment philosophy that puts your interests first and prioritises you the client before anything else.

The difference between a poor investment and a great one is huge, and having a sensible investment philosophy that you stick to over time will make a huge difference to your life.

Whether you are 16 and have just started your first job at McDonalds, have just retired, or are 85 years old, investing is important. You are never too young or too old to learn something new. While it helps to start investing younger, it’s never too late to get going.

While some people think that you need to be rich to be a successful investor, or have access to the best investments, this is not true. There are many successful investors and wealthy people who started small. And there are many very wealthy people who have bad investments, or who make money in business but then invest in dumb ideas or hand their money over to others to invest.

I made some bad investing mistakes when I was young. I remember investing in a tip from a friend during the tech boom of 2000/2001 and losing a few thousand dollars. But if I’d simply invested that money in the manner I now know works, and which this book explains, and paid regular instalments, that few thousand would be almost $100,000 today.

Instead it’s worth zero. If only I’d known then what I know now!

From my own Mum’s experience to that of the many clients I have worked with over the past 20 years, I want to share stories and experiences to help you avoid some simple mistakes and lead you to an investment approach backed by decades of academic and Nobel prize-winning research that will give you a much greater chance of success.

This research is publicly available and has been for decades.

Is there a higher priority than ensuring you know how to invest properly for your future?

With the rising costs of living in basic groceries, health services and house prices added to our longer life expectancy that strain on governments, it is important that all Australians do what they can to learn how to be as financially independent as possible.

The reality is that most Australians have not had any education in investing or finance, and don’t have access to honest independent resources. Unfortunately, what they do have access to for investment decisions are industry marketing, advertising and media reports .

And it’s even worse than that, as we have discovered through the Royal Commission into Financial Services: banks and their sales people have not acted in their clients’ best interests. They have acted in their own interests both at a personal and a corporate level so they were conflicted when it came to providing advice to their clients. It’s not only the banks which have been at variance. Many large super funds and industry funds, accountants and brokers have also been questioned on whether they have been putting the end customers’ interests first.

As a result of this, and a confusing investment, tax and superannuation system, most investors end up doing exactly the opposite of what they should be doing.

There is, thankfully, plenty of independent, peer-reviewed research dating back to the 1950s on how best to invest. The leading minds in finance have looked into this challenge for the benefit of us all, and the findings are remarkably consistent: there is a different and better way to invest.

These Nobel-winning findings and evidence are widely known in academic circles, but the problem remains that the investing public – you – remains largely unaware of them and no one has made much effort to inform you.

The primary reason for this is that many investment advisers, industry commentators and so-called experts are either unaware of this research or choose to ignore it. Or I can be cynically blunt and say there is no benefit to them if they tell you about it.

As an independent investment adviser, I have battled to communicate this story to my clients for over 20 years. Battled because, despite being widely researched and validated by decades of academic research, very few advisers have implemented this approach in Australia. Very few ‘experts’ in the press address this evidence sensibly. Evidence-based investing is not sexy for the media, and the philosophy of those designing the investment products (and that’s all they are) has been to train their salespeople to sell on commission.

My role has been and continues to be to simply work for clients and ensure their investments are the best possible for them.

It is my professional obligation to put my clients’ best interests first. I am grateful to have come across a firm by the name of Dimensional Fund Advisors early in my career , and learned this fundamental ethical, and now legal, obligation via my chartered accounting exams and experience.

I was introduced to Dimensional in 2001 simply because they never have and never will pay commissions to induce ‘advisers’ to sell their products. In the investment industry this was and is unusual and refreshing. I was a fee-only adviser — very rare in 2001! I went to meet Dimensional with my then boss. The fee-only model has influenced my whole career, although the fee-only approach has not been an easy one to market, because the industry does a great job of convincing you that their high-cost, commission-loaded products are better. And they have way larger marketing and advertising budgets. In my previous roles, investment committees disapproved of the concept because it did not pay upfront commissions, and peers ridiculed it as if it were some type of cult. Sometimes the right way can be more difficult, but it has been worth the effort and endeavour.

The vital principle underpinning my fee-only path has been the continual search for what is best for my clients. If you truly put your clients first, then this is the only way for advisors to implement portfolios and give clients the best chance of success, and also to apply appropriate governance as a trusted fiduciary with the responsibility of managing peoples’ money.

If you are using an adviser who does not use a fee-only strategy, it’s time to start again. In my view, this means they are not working simply for you: they are putting their own ego and interests before yours, making decisions based on the commission they will receive.

There are billions of dollars invested through a fee-only approach globally, although it’s a fairly small segment of the investment market in Australia due to the banks having controlled the market for so long and many advisers coming from sales roles in banks rather than being guided by professional principles. [2] Banks have an important role in our system but, as we know, they do not do a great job in providing financial advice because they put their own interests before yours.

This book shows a better way to invest: one that puts you, the client, first.

Before I get to the investment philosophy and the ‘how’, it’s important to understand why being a better investor is so important.

There are 10 key reasons why you should understand the facts about investing, and how that can make a big difference to your life.

Chapter 1 Summary

- With trillions of dollars invested in superannuation, isn’t it time we all took more interest in our money?

- Australia is an intelligent country by many standards

- However, we have very poor financial literacy

- Most Australians know very little about how their superannuation is invested.

[1] Image source Https://financial capability.gov.au/

[2] Many regulations have been introduced recently to try and improve the standard of advice in Australia, the latest being the Financial Adviser Standards and Ethics Authority (FASEA) requirements aiming to improve educational standards.