As with any investment made in life — a family, a home, a university education—the best results are achieved by carefully constructing a plan and then following that plan consistently over time.

A well-crafted investment plan and investment policy statement provides a broad context for making important financial decisions and then prescribes a prudent investment philosophy and set of investment management procedures for achieving your long-term financial goals.

Having an investment philosophy, we believe is paramount to your long-term investment success.

In this series, we will look at the 5 steps to building an investment strategy.

Step 1 – Assess your goals and circumstances

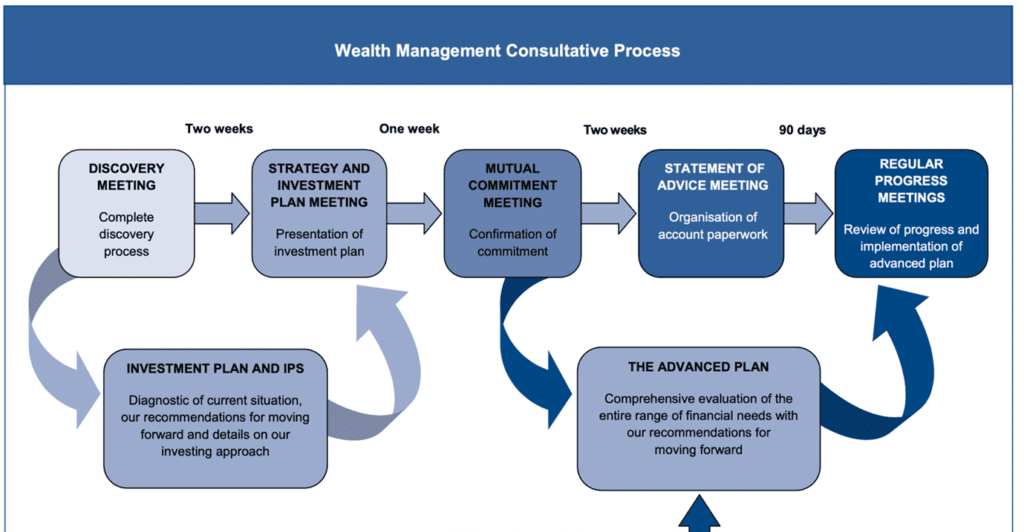

The investment plan process begins during the Discovery Meeting with a discussion of your financial values and goals, as well as your key relationships, existing assets, other professional advisors, preferred process, and important interests.

Long-term investment success means different things to different people. The best investment plan for you depends on your specific circumstances and objectives. That is why we began the investment planning process with a discussion during our Discovery Meeting of your values, goals, relationships, assets, advisers, preferred process, and interests.

While everyone’s situation is unique, certain factors matter in creating any investment plan. These factors include the purpose of the investment, its size, sources and planned uses of the funds, and the amount of uncertainty you are comfortable having. By thinking clearly about your goals and circumstances, you build the foundation of an investment plan that best matches your needs and the realities of the financial markets.