Right now, we are seeing so many “experts” predict a market crash. Before you follow their lead, let us run through some investment principles.

As investors, we have to consider how we react to these media headlines. There are two decisions here. Do we respond and accept uncertainty, or do we stay with our longer-term strategy that has worked in the past?

The number 1 fact about markets is, they are always unpredictable and always will be. This is not new information.

It is important to use an investment philosophy that works in all market conditions.

Yes, markets are unpredictable, which makes it “scary” for some, and why there is the temptation to follow someone who “knows what is going to happen”.

One of the best quotes I have heard is, ‘anyone trying to predict what will happen in markets is simply trying to take money from your back pocket and put it in theirs’, too true. A simple look at the Standard and Poors data of the success of market timing fund managers, shows us that the chances of success are so slim using this approach that you are better off taking tips off a chimpanzee. As the old ‘don’t smoke’ advertisements use to say – “Just don’t do it.”

The good news (I’m always excited to share this, it is a revelation for all investors) is that you don’t need to predict what will happen to have a successful investment experience. It is strange but true. A lot of reports from the media and many parts of the industry want you to believe that it is possible to predict the future – and this is not in your best interest. Before you scowl and lose faith in the investment industry – is there any other industry like this you can think of that uses advertising, to sell you a product that suits “them” more than it works for you. Mmmm, yep. Investing is just like many other aspects of life; you need to sift through the noise and find the source of truth.

The truth is, the less you worry about what is happening next in markets, the better your investments are likely to perform. Ouch, that hurts all those investors who have wasted a large part of their life trading. They will not let go of the belief that they can “predict” and “pick” the market. It takes years of “undoing”.

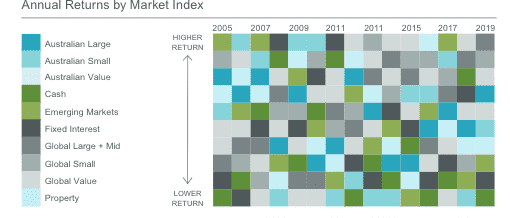

The chart below shows how random market returns are. So, next time you hear someone predicting what will happen next – ask how they fared over the past 1, 5, 10, 20 or 30 years before you “back” their guess and ask for the evidence. That is what we do here for clients when a manager tells us how good they are, we look at the data. They only make it into your portfolios if they have demonstrated value over decades, not just a month or year. We take this seriously.

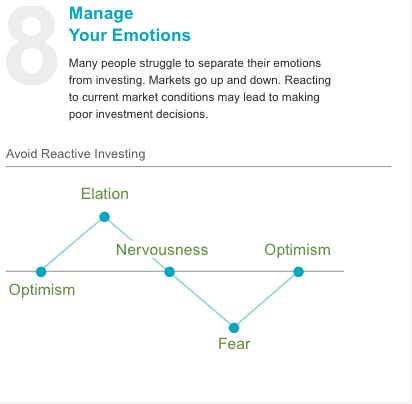

Our minds are not tune to be good investors.

Daniel Kahneman won a Nobel prize in economics in 2002 for his research into behavioural science. He explains that we are not wired to make intelligent investment decisions. Our emotions and biases get in the way.

Let’s take a walk-in time back to March 2020. Were you a buyer or a seller? Come on, be honest. The world was collapsing, and every news agency and market expert in the world was predicting very tough years ahead. Many even said it would be worse than the depression, and even though very few reading this lived through the depression, our minds take us to thoughts of living in shacks, no jobs, no food and desperation.

They were all wrong. Every single expert’s predictions were so dire that markets had their best years since the 1980s!!! How could they be so incorrect, these experts?

(Hang on, you were asking should you sell down now because you read someone said yesterday, we are about to see the worst market crash ever!)

We all know this graph, right. – buy high, sell low.

If market timing is so easy and predictable – we would all do it! We all know the emotions of investing and that we should sell high and buy low. So right now, we should rebalance into, are you kidding me, cash and bonds?!!! That is the dilemma. While property and shares have produced returns of over 20%, cash is almost zero, and bonds may be around 3-4%.

So, what is the message – how do I deal with all these predictions – what if they are right?

The key is to stick to YOUR long-term plan, not someone else’s.

Are forecasters always, right?

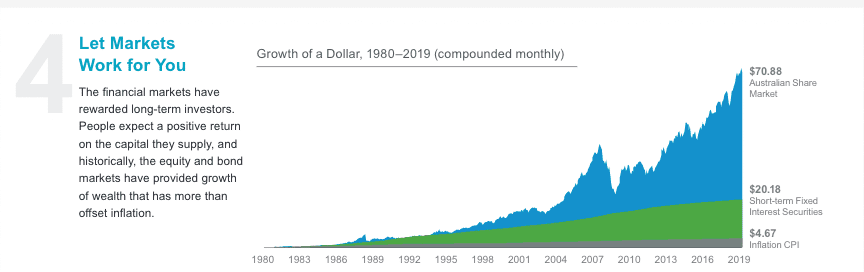

We know that long term returns from capital markets are good if you let markets work for you.

Why rebalancing works

Your decision is, of course, not to react to one person’s prediction of the market but to understand the possible downside risk for you and mitigate that via rebalancing.

If you are 65, drawing money from your super fund, you need funds in cash and fixed interest or bonds to cover your drawings and this medium-term risk of markets falling. If they do fall, you can sleep easy. If they don’t, you still have funds invested sensibly and diversified in growth markets. What markets do today, tomorrow, or the next day really should not worry you? If you are worried, we are not doing our job.

If you are 45, and the portfolio is in superannuation, you unable to access it for at least another 15 years, a fall in markets is perfect and time to buy in!

The reason to rebalance now, and at least once a year, is to manage risk because no one, not me, the guru, the astrologers, or economists, knows precisely what is around the corner.

Conclusion

No one knows precisely where markets are heading. This is not news; no one ever has known. Despite considerable improvements in technology and data, there is still no way to predict future markets accurately.

But that is ok; you don’t need to predict markets to have a successful investment outcome.

In fact, the less you try and predict – the higher the chance of success!

The correct asset allocation for you is one you can stick with over time. Last year, we recommended rebalancing back into markets when they fell. We did not recommend this because we “knew” what would happen next. We did not know that markets would rebound so quickly.

We recommend rebalancing because it’s just one of our investment principles that will keep you on track, take the worry out of investing, and lead to excellent outcomes.

Rebalancing last year, this year and in the future is the right “call” because we have an investment philosophy that has stood the test of time. It is backed by decades of academic research and data through all cycles, disasters and good times. It works, and to date, there is no better way to implement it. We keep searching and will always. But nothing else stacks up so far if our combined objective is to invest with as much certainty as possible.

Remember, those that sold out last year in March did not have the wrong approach in March; they had a faulty system before March and most likely still do.

Oh, and a question I always ponder is – If you react to these “forecasts”, what exactly do you do? And when do you “buy” back in? When will they tell me? And how? and how first?

Will the “guru” call you first? Or place their trades and get in first? It is simply not a sensible or calculated investment strategy for intelligent investors.

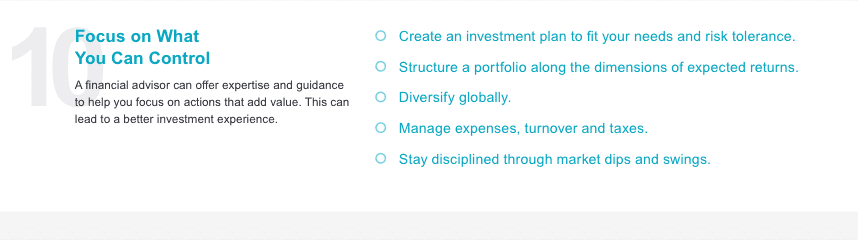

Focus on what is good for you and what you can control.

- The best asset allocation is one that you can stick with.

- Diversification, when done correctly, works.

- Implement using science, not guesswork.

- Tune out the noise and the so-called “Predictors ” – check their track record if you must.

- The outcome – Relax and enjoy what you like doing best.

For more about our approach, visit www.archcapital.com.au

To make an appointment go to www.archcapital.com.au

For a copy of our 10 Investment Principles, Click here