There is not a huge amount going on in this budget. The current budget is benign with the aim to being, in the words of Dr Jim Chalmers, ‘solid, sensible and suited to the conditions.’ But it is important that you understand what the changes are because they may impact your financial plan.

Super Downsizer Contributions Eligibility Age Reduction

The minimum eligibility age for the downsizer contribution is proposed to reduce from age 60 to 55. The downsizer contribution allows individuals to make a one-off contribution, up to $300,000 from the proceeds of the of your home into your superannuation fund. This measure aims to encourage more Australians to downsize sooner by providing greater flexibility.

Lift to the Commonwealth Seniors Health Card income threshold

The income threshold for the Commonwealth Seniors Health Card will be increased from $61,284 to $90,000 for singles and from $98,054 to $144,000 (combined) for couples. Commonwealth seniors’ health card is basically the card you’ll apply for to get some pharmaceutical benefits and things like that if you’re not eligible for the age pension.

Encouraging Pensioner Workforce Participation

The government are providing pensioners with a once off increase to the Work Bonus income bank of $4,000. Allows pensioners to earn from $7,800 – $11,800 in the 2022/23 financial year before their pension is reduced. A number of elderlies who are on the age pension would love to do some work because it gives them a little bit more money and also it gives them a little bit more purpose and something to spend their time doing.

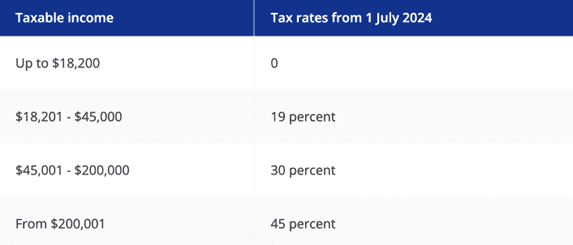

Personal Income Tax Rates

As of the October Budget, there is no change to legislated stage 3 tax cuts for individuals. In 2024-25 financial year, the 37 percent bracket will be removed entirely, and 32.5 marginal tax rate will reduce to 30 percent. In addition, the threshold above which the top marginal rate of 45 percent applies will increase from $180,000 to $200,000. These a just a proposal, yet to come in effect and may potentially change in future budgets.

Obviously, this just covers the surface of proposals from the Federal Government. If you’re interested to dig deeper there is a lot of material out there that cover the intricacies of the budget. But this just mainly highlights what may impact you and your financial plan.

Disclaimer:

Arch Talk blogs offers general advice only which means that we have not taken into account your personal or specific goals or requirements. The information and tools on this website do not in any way recommend products based on a needs analysis. This information has been prepared without taking into account your objectives, financial situation or needs and you should consider if the information is appropriate for you before making an investment decision. If you would like to receive personal advice, please use the contact us form on the website or call 02 9905 9001. All rights reserved | Australian Financial Services Licensee: AFSL # 234543 Pooledfunds Pty Ltd ABN 28073437742