Investment bonds can be a handy little tool to keep in your toolbox when it comes to managing your wealth. If you’re new to the world of bonds, it’s easy to be intimidated. They seem complex at first but it’s not hard to become knowledgeable in this field, so don’t be discouraged – you should know what you hold and why.

What is a Bond?

You may hear different terminology to describe a bond such as debt instruments or fixed income. In spite of these complex titles, think of them simply as a loan funded by investors. So, when you purchase a bond, you are effectively loaning out a portion of debt to the issuer (seller).

Source: Vanguard

A bond sits within a portfolio’s fixed income allocation alongside products such as cash and term deposits. These assets are classified as income assets as they provide a steady and reliable stream of income.

The Mechanics of Bond Returns

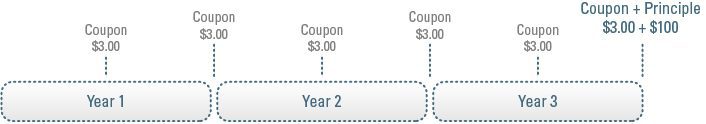

These entities issue debt to finance their operations and promise to repay investors the full amount (face value), plus regular interest payments (coupons), in a specified time frame.

The income component of a bond can fixed or floating rate of interest known as the coupon. These coupons are paid periodically, on a semi-annual basis until the bond matures at which time the bond holder receives back the original loan amount, known as the principal.

Source: Vanguard

You can hold a bond until maturity or trade it on the bond market. Majority of investors tend not to hold bonds all the way to maturity, rather buy and sell in the secondary market, profiting off price fluctuations.

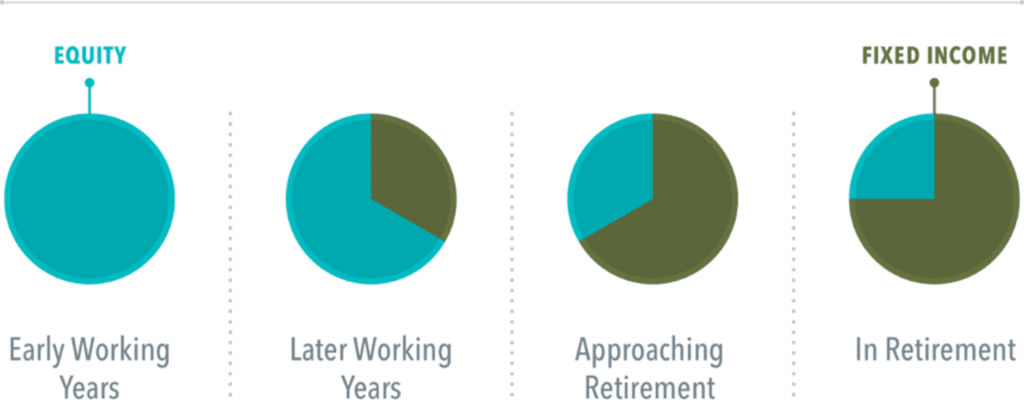

An Increased Focus on Managing Risk

Bonds serve varying roles in a portfolio. The most common roles are providing investors with access to a defensive asset class – less risky alternative to equity but more risky than cash – which helps dampen volatility from equities, preserves capital by providing income and hedges inflation. The charts below show investors with shorter time horizons are interested in short-term bonds that provide safeguard against market volatility.

Source: Dimensional

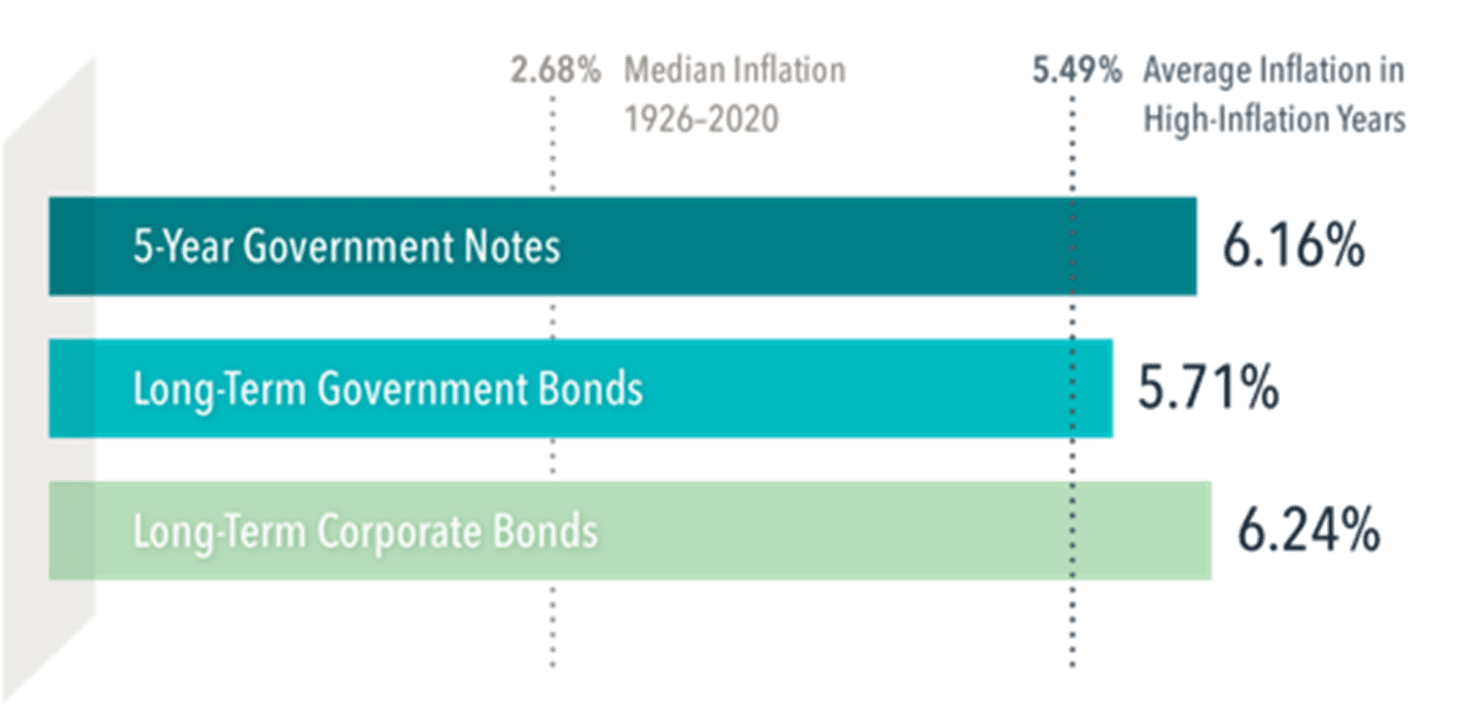

History has shown that many fixed-income investments have outpaced even relatively high inflation.

Source: Dimensional

All Investments Have Risks, Even Bonds

Regardless how safe fixed income may seem, they’re still subject to risk. The two main key risks associated with bonds are their sensitivity to changes in interest rates and credit (issuer fails to repay investors at maturity).

When interest rates rise, bond prices fall, and vice versa. The table below shows the relationship between interest rates, bond prices and the yield.

Source: Vanguard

The degree of sensitivity of these rates are reflected in its average duration and the type of bond. Generally, higher duration bonds are more interest rate sensitive than lower duration bonds.

The Word “Bond” is a Big Umbrella.

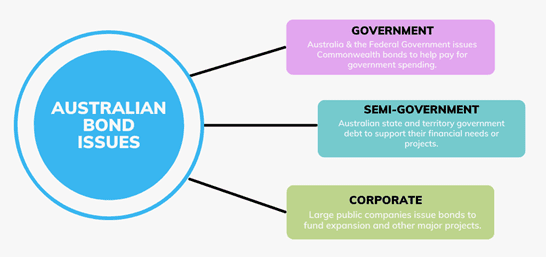

There are many types of bonds, ranging from safe government bonds to corporate bonds that perform differently due to their rating. A top-rated government bond will perform at a risk-free rate hence a lower than expected return. Corporations can issue bonds too, the quality of which depends on their financial strength. The higher expected return associated with a higher risk.

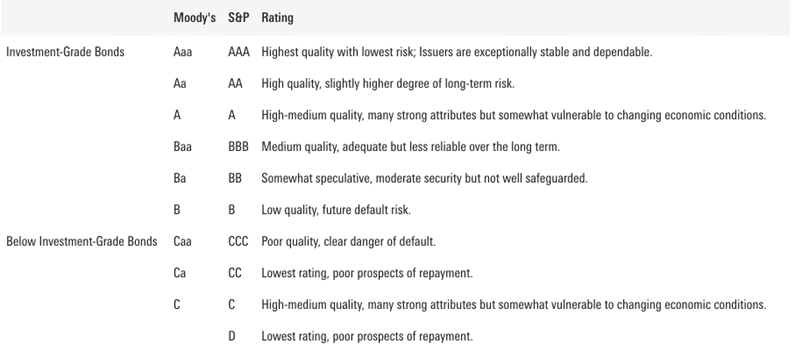

Most bonds are graded

Credit rating agencies assign rankings to different bonds. These ratings influence the yield which they’re traded at – the lower the rating, the higher the risk therefore the higher interest paid. This can help bond investors to gauge the financial strength of the bond issuer. Bonds rated AAA, AA, A, and BBB are considered investment grade with a relatively low risk of default, as indicated by their credit rating.

Source: Standard & Poors

Recent Bond Market Condition

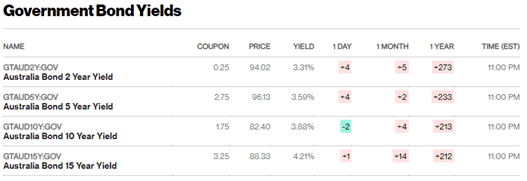

The Reserve Bank of Australia hiked its key rate by another 25 bps to 2.85% this month, with further increases to continue as inflation in Australia is too high. This has caused further decreases in bond prices and increase yields with 10-year government bond yields are hovering around 4 per cent. Most investors expect the current monetary policy tightening cycle to conclude sometime in 2023 as price pressures ease, so expect this trajectory for a while.

Source: Bloomberg

FOOTNOTES

1 ‘Making Sense of Bonds’, Dimensional, Feb 25, 2022

Disclaimer:

Arch Talk blogs offers general advice only which means that we have not taken into account your personal or specific goals or requirements. The information and tools on this website do not in any way recommend products based on a needs analysis. This information has been prepared without taking into account your objectives, financial situation or needs and you should consider if the information is appropriate for you before making an investment decision. If you would like to receive personal advice, please use the contact us form on the website or call 02 9905 9001. All rights reserved | Australian Financial Services Licensee: AFSL # 234543 Pooledfunds Pty Ltd ABN 28073437742