Step 3: Plan Your Asset Allocation

Because it is so important, asset allocation is the first investment decision. During this process, we establish your attitude to risk to then determine how much of your portfolio to invest in each of the different investment types, or asset classes, including shares, bonds and short-term investments, both domestic and international.

If you have been careful in setting your long-term investment objectives, then you can be successful in planning your investments. Once we have worked with you to determine your time horizon and risk attitude, and satisfied you with a feasible rate-of-return objective that will meet your needs, we can begin the task of building your investment portfolio. The first step in this process is asset allocation.

Asset allocation is the process of deciding how much of your portfolio to invest in each of the different investment types, or asset classes—shares, bonds (also known as fixed interest) and short-term investments (both domestic and international), as well as hard assets such as real estate. Asset allocation should be your first investment decision because it is the most important.

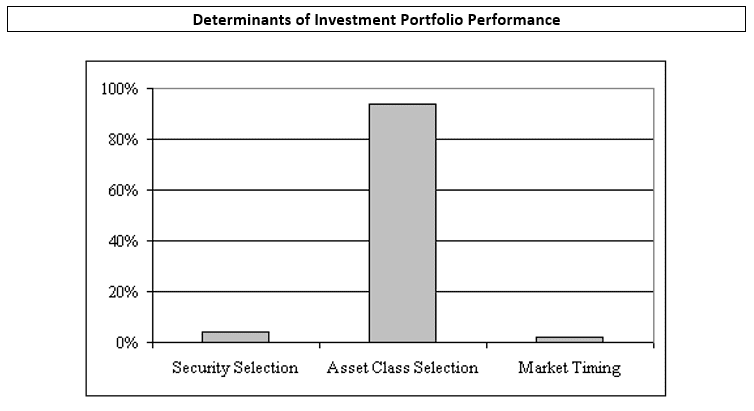

To investigate how important asset allocation really is, three leading American investment experts performed a comprehensive statistical study to measure the importance of various factors in determining a portfolio’s performance. They studied the results of 91 major corporate pension plans over a ten-year period which included both good and bad markets. Their conclusion was that, on average, 94% of the variability in returns could be explained by the plans’ long-term asset class policy (see chart below). The remainder was attributable to individual security selection (4%) and market timing (2%).1 However, even though security selection and market timing explained 6% of the variability of returns, the overall contribution to performance was negative. The average plan lost 0.66% per year from market timing decisions and another 0.36% from security selection. The authors conclude: “Because of its relative importance, investment policy should be addressed carefully and systematically by investors.”

We thus see the importance of investing for the long term, regardless of the management style. This is true because an investment plan’s success cannot be fully realised until the underlying portfolio has gone through the various economic and market cycles that will be experienced over a long period, such as ten years.

Equities vs. Fixed Income

The most basic asset allocation choice is between equities and fixed interest investments. Equities represent participation in the long-term growth of companies and of the economy, while fixed interest investments represent fixed obligations of governments and corporations. It seems natural, then, that equities should offer superior long-term growth potential, while fixed interest investments offer more stability. The choice of allocation between equities and fixed interest is a clear example of the basic investment trade-off between risk and return.

In exploring asset classes, we begin with the historical performance of investment categories. This is not to say that the past indicates future performance; however, it does indicate reasonable relationships between various asset classes.

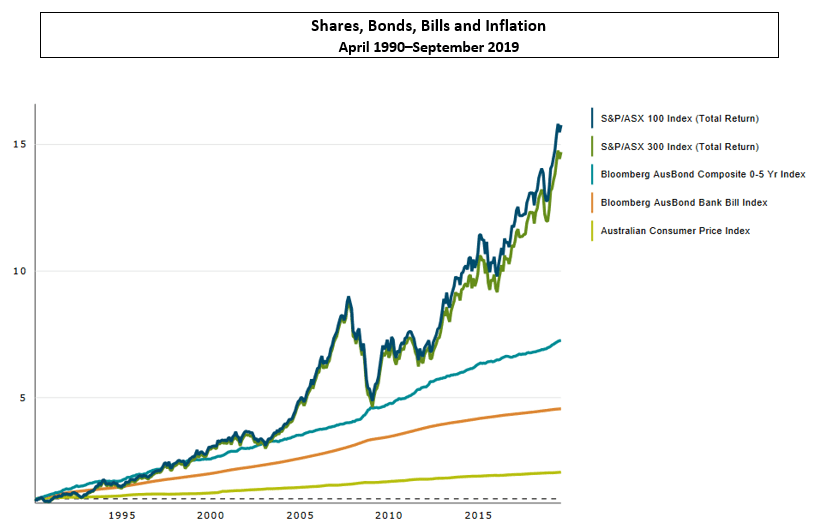

By referring to the graph below, you can see that historically, equities have far outperformed fixed interest securities. For example, $1 invested in common shares (as represented by the S&P/ASX 100 Index) in April of 1990 would have been worth $15.77 by the end of September 2019, while an investment in the broader market (as represented by the S&P/ASX 300 Index) would have been worth $14.71. Fixed interest vehicles have trouble even keeping pace with inflation. That same dollar invested in a composite bond index would have been worth $7.25. If invested in Australian Bank Bills, this dollar would have been worth $4.56. Simply to maintain purchasing power (to stay even with inflation) an investor over this period would have required an increase in value to $2.06.2

Modern Portfolio Theory, which we will discuss in more depth later, would suggest that investments in equities would be likely to continue to produce higher returns than those in fixed income, given the higher risks inherent in equity markets. These risks are primarily due to the cyclical swings of the share markets.

These cyclical swings are of greatest concern to those who will have to liquidate their investments in the near future. Typically, the longer one’s investment horizon, the more prudent it is to attempt to achieve a higher rate of return by investing a larger portion of your portfolio’s assets in equities.

That said there is often a place for both equities and fixed interest investments in a prudently-designed portfolio. In a strongly-rising share market, some investors are tempted to move to an all-equity portfolio in order to capture those gains. However, such a move can result in dramatic swings in the portfolio’s value, and may leave the portfolio vulnerable to a substantial drop in value once the market has ceased its run-up.

Likewise, other investors, who are near or in retirement, often wish to remain “safe”—to protect themselves from share market swings—by holding an all fixed interest portfolio. However, as we note below, such a portfolio will tend to achieve returns only approximately equal to the rate of inflation. Without the inflation-beating potential of equities, such a portfolio is subject to a gradual erosion of its value over time.

The bottom line: building a prudent portfolio requires careful consideration of the unique characteristics of both equities and fixed income and what each can add to the portfolio.

Fixed Interest Investments

As the long-term returns figures show, an all-equity portfolio has attractive growth potential, but significant uncertainty about the exact outcome. For this reason, we describe an all-equity portfolio as being aggressive. It is most suitable for investors who are willing and need to take substantial risk in the pursuit of reward.

Investors with shorter investment horizons, a high level of risk aversion or less need to take risk should maintain portfolios that are significantly less aggressive than the all-equity strategy. For these investors, some portion of the portfolio should remain in fixed interest instruments. Bonds provide income and help reduce the overall risk in a portfolio. However, because of the fixed nature of the income stream from a bond, there is comparatively little upside potential in a bond portfolio. Investors are sometimes surprised to learn that bond prices can rise and fall with changes in interest rates, but the main source of investment returns from bonds are the interest payments they make.

A portion of your portfolio’s assets will be invested in high-quality fixed interest investments. Fixed interest investments will help reduce the overall level of risk in your portfolio, because fixed interest investments tend to be less risky than equities, and because the fixed interest investments represent an additional diversification of your assets. Fixed interest instruments should be used to reduce the overall level of risk to your comfort level. It is important to note that over the long term, fixed interest investments will typically have returns approximate to inflation.

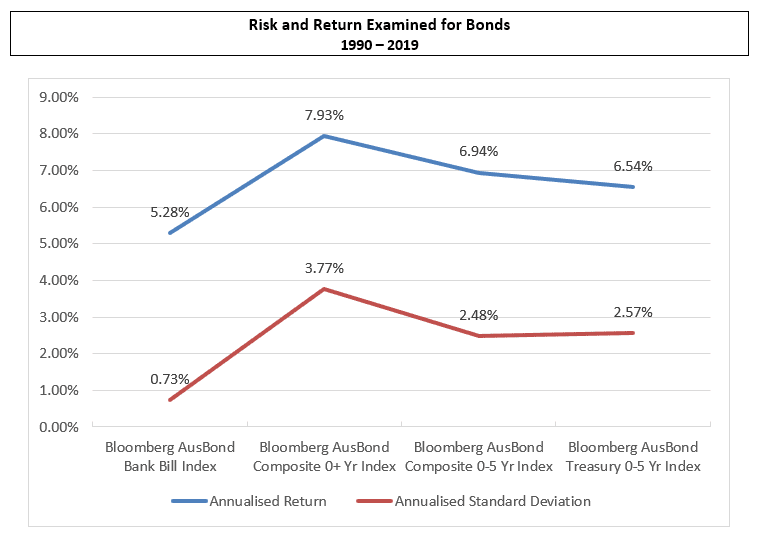

The fixed interest investments for the portfolio will typically be in either short- or intermediate-term bonds. Research by Eugene Fama at the University of Chicago and other respected academics has shown that long-term bonds historically have had wide variances in their rates of total return without sufficiently compensating investors with higher expected returns.3 In terms of variability of total return, long-term bonds look more like shares than shorter-term fixed interest vehicles such as Treasury bills. Yet, over long time periods, their respective total returns have consistently lagged behind those of equities. A look at the following graph will help illustrate the higher standard deviations (volatility) and lower total returns of bonds with maturities beyond five years.4

Our purpose in holding some fixed interest investments is twofold; first, to mitigate the risk (volatility) of your overall portfolio, and secondly, to generate income through bond yields. Subject to a given level of risk, we believe a combination of equities and high-quality, short- to intermediate-term fixed interest instruments is the most effective way to achieve your objective of maximizing returns. Replacing the traditional long-term bond holding with a combination of equities and short- to intermediate-term fixed interest vehicles should maintain the portfolio’s expected rate of return while decreasing its volatility.

Equity Investments

Generally, we will focus your portfolio’s equity investments in “asset class funds” or close proxies for asset class funds. An asset class fund is a managed fund designed to broadly represent the market, or some significant segment of the market (such as the shares of large companies or the shares of emerging international markets). These funds invest in a large number of the shares of their defined segment of the market to provide returns closely approximating the returns offered by that particular segment. By using asset class funds, we hope to lower risk by increasing diversification, achieve market segment returns and minimise costs. By choosing the asset classes that have the highest expected return, we hope to equal the total market’s performance with less volatility. Where asset class funds do not appear, from our research, to be the best or most economical option, we may revert to holding a typical index through the use of an Exchange Traded Fund (ETF) – best described as a “basket” of shares, designed to replicate a particular index or segment of the market, at the lowest cost available.

Domestic Equity Investments

We typically chose, as our domestic equity asset classes, shares of Australia’s largest capitalised companies and some small shares. We chose these because these groups have the highest expected returns and because academic research shows that the largest and smallest companies’ shares have low correlation with each other. In other words, in most investment periods, these two asset classes would be the best and worst performers.5 Building a portfolio containing asset classes with low correlation to each other has been shown to provide greater long-term performance for the investor, while reducing risk through diversification.

Growth vs Value

Another important issue to consider when allocating equities in a portfolio is the distinction between growth stocks and value stocks. Growth stocks are generally regarded as those that are expected to grow at an above-average rate when compared to the market as a whole. In contrast, value stocks are generally considered by many to be the “bargains” of the market because they tend to trade at lower prices relative to their fundamentals, such as dividends and earnings.

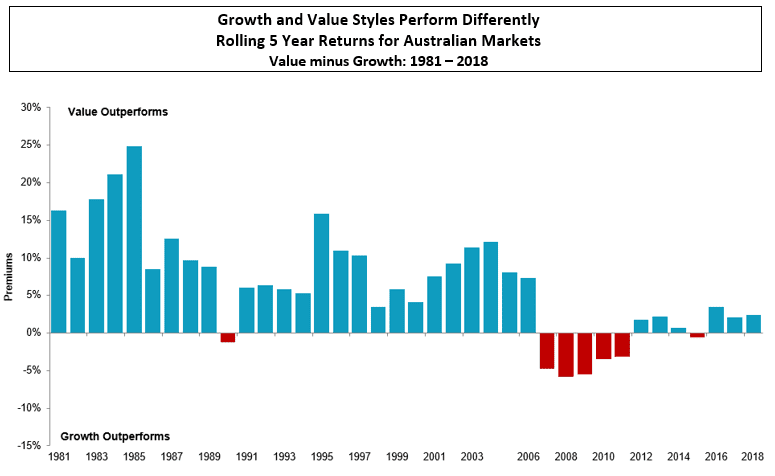

Because the two styles are so different, it’s unusual that they both work well at the same time. The following chart shows the importance of diversifying between both growth and value stocks.6 Investment returns in value stocks have outperformed growth stocks at irregular intervals, which emphasizes the importance of maintaining a style-diversified portfolio.

International Equity Investments

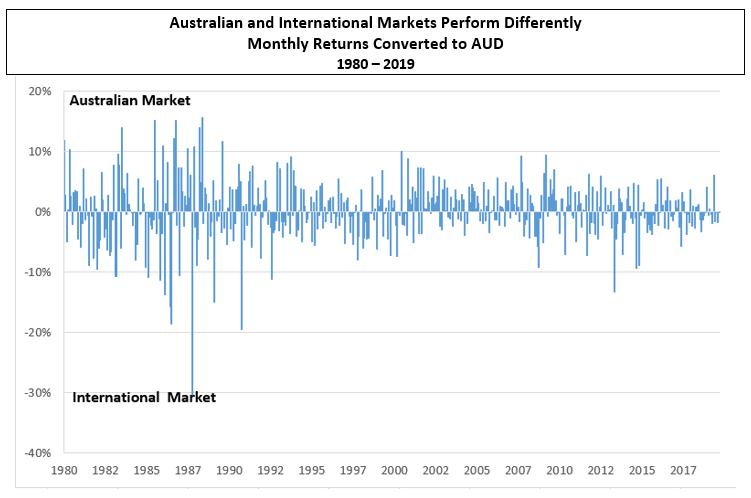

The international and Australian markets also historically have low correlation. In addition to taking advantage of the high returns attainable in the domestic equity markets, your portfolio will invest in overseas equity markets. The primary reason for this is increased diversification, which is designed to lower risk.

Thus, by diversifying internationally, you can lower the volatility of your portfolio by combining asset classes with low correlation, while still enjoying the superior returns of the equity markets.

The chart below shows the importance of global diversification.7 Investment returns in international markets have outperformed domestic-market returns at irregular intervals, which emphasise the importance of maintaining a globally diversified portfolio.

When two investments have similar long-term returns, and yet have such dissimilar patterns in their short-term outcomes, you can then preserve your portfolio’s growth potential and reduce risk at the same time by investing in both.

A segment of your portfolio will be invested in asset class funds comprised of shares of small companies outside Australia. The small-firm effect has been identified in international equity markets as well as in Australia. In fact, available evidence implies that the effect is even stronger in the major international markets (ie. higher return and lower risk).8

The important thing to realise is that mixing domestic and international shares is a powerfully advantageous investment strategy. While investors all over the world tend to emphasise investments in their own home markets, if you do not invest in overseas equities at all, you miss two important benefits. First, overseas investments allow you to participate in the growth of the whole global economy. Second, international equities are a powerful diversifier, allowing you to reduce risk without sacrificing the growth potential of equity investments. By investing in small shares and value shares overseas, your portfolio will gain even greater diversification from the domestic equities you hold.

Emerging Market Equity Investments

Most global portfolios include a small portion in emerging markets. In today’s world of equity investing, we are seeing a great deal of growth in emerging markets. The growth rates in these markets have been significantly greater at times than the rate of growth found in established markets. Research indicates that a very small position in emerging markets can increase the return of the portfolio without increasing overall portfolio volatility. In fact, because of the low correlation between the emerging-market asset class and the other asset classes, the overall portfolio volatility can be reduced.

In order to minimise the risk of investing in the inherently riskier realm of emerging markets, we choose funds that have established stringent selection criteria in choosing appropriate countries to include in this asset class.

Criteria for Country Selection

In order to be considered for inclusion in the emerging-market asset class, a country must have the following:

1. A relatively stable political environment

2. A well-organised financial market

3. A market that provides ample liquidity for its shares

4. A sound legal system that protects property rights and upholds contractual obligations.

While these markets are defined as emerging, the companies within the asset class are well-established companies in those countries. Typical holdings are the national banks, the land developers and telephone companies of the various countries concerned.

1Gary P. Brinson, L. Randolph Hood and Gilbert L. Beebower, “Determinants of Portfolio Performance,” Financial Analysts

2Source: Australian Consumer Price Index from the Reserve Bank of Australia.

3For example, see Edward L. Martin, “Intermediate-Term Bonds,” AAII Journal, January 1991, pp. 13-16.

4Bloomberg Indicies 1999-2014: DFA Returns program.

5Dimensional Fund Advisors, U.S. Small Company Strategy.

6The difference between the S&P/ASX 200 Index Accumulation and the Dimensional Australia Value Index. Monthly annualised returns.

7The difference between the S&P/ASX 200 Index Accumulation and the MSCI World ex Australia Index (net div.)

8Dimensional Fund Advisors, Inc., “International Small Company Shares—A New Dimension for Institutional Investors” (1987); also “International Small Companies,” a DFA presentation (1990). Updated, 2002.