Step 4: Select your investment approach

With an asset allocation in place, we now select the investment vehicles that you will use to implement your portfolio strategy. Two key investing principles guide these decisions: the importance of diversification and the value of remaining invested.

As noted previously, the most important factor determining your investment outcome will be your asset allocation. Once you have determined your asset allocation, the next step is to select the investment vehicles that you will use to implement your portfolio strategy. Two important principles of Modern Portfolio Theory should guide this selection: (1) Diversify and (2) Stay invested.

Elements of Modern Portfolio Theory

The basis for the principles of your investment plan is a collection of the best evidence from the academic disciplines of economics and finance. Investment experts usually summarise this evidence as a body of knowledge called “Modern Portfolio Theory.”

The foundation of Modern Portfolio Theory was a 1952 paper, “Portfolio Selection,” by Dr. Harry Markowitz, in which he established a theory explaining the best way for an investor to choose a portfolio. His basic theory was that investors should choose a portfolio that offers the best return for a given level of risk—the efficient portfolio mentioned previously. Later work by contributors such as Dr. William Sharpe added to our understanding of how to choose the best portfolio from among a specific set of securities.

Modern Portfolio Theory is of such fundamental importance in investing that the economists who formulated the theory received the Nobel Prize in Economic Science in 1990.

Modern Portfolio Theory has four basic premises. The first is that investors are inherently risk averse. Investors are not willing to accept risk, except where the level of returns generated will compensate them for that risk. Investors are often more concerned with risk than they are with reward.

The second premise is that the securities markets are efficient. Most studies support this idea. In fact, advancing information technology and increased sophistication on the part of investors are causing the markets to become even more efficient.

The third is that the focus of attention should be shifted away from individual securities analysis to consideration of a portfolio as a whole, predicated on the explicit risk/reward parameters and on the total portfolio objectives. The efficient allocation of capital in your portfolio to specific asset classes will be far more important than selecting the individual investments.

The final premise of Modern Portfolio Theory is that for every risk level there is an optimal combination of asset classes that will maximise returns. Quantitative methods can be used to measure risk and to diversify effectively among asset classes. Portfolio diversification is not so much a function of how many individual shares or bonds are involved as it is of the relationship of each asset to every other asset. The percentage and the proportionality of these assets in the portfolio are of paramount importance.

1. Diversify

One reason why many investors are reluctant to invest much in the share market is that they know many stories of companies and shares that have suddenly fallen on hard times. Some investors imagine an investment in the share market to be like that—when a share has gone very high, it may be just the time that it is about to fall sharply. The mistake they make when they think this way is that they forget that while a single share may rise or fall dramatically, the movements of the overall market are generally much more subdued.

Modern Portfolio Theory provides the reason. It explains that two effects govern the movements of every share market and share-specific events. It is primarily the share-specific events that cause individual shares to move up or down wildly relative to the overall market. You may think that your best protection against share-specific risk is to have portfolio managers that know all the companies in your portfolio well. The trouble is the events that cause the most damage to shares usually come as a complete surprise. A company may have a sudden product liability problem, or the chairman may die or come under a cloud. On the upside, the company may make a surprise new product announcement, or land a major contract. These events are often unanticipated, and so they cause price movements that not even the best portfolio managers can expect. In fact, Modern Portfolio Theory tells us that if the market can anticipate an event, then the effect of the event is already evident in the share’s price, and no further profit from knowledge of the event is possible.

If it is surprising that portfolio managers cannot anticipate a share’s movement, then how can an investor protect a portfolio against them? The answer is diversification. The share-specific movements of individual shares may not be predictable, but over a diversified portfolio, they tend to cancel one another out.

Modern Portfolio Theory tells us that we can build diversified portfolios to greatly reduce share-specific risk, but that market events, which affect all shares, are not diversifiable. That is, even a diversified portfolio of shares is subject to the overall movements of the market. Fortunately, the theory predicts that the market rewards us for taking this risk by giving us generous long-term growth potential. The asset allocation decision is where we decide how aggressively to pursue this long-term growth.

2. Stay Invested

Investors often ask: when is the right time to enter the market? For a long-term investor, the answer is today. There is no short-term investment opinion behind that statement. No one can predict the movements of the market for the next month or year.1 Just as with unanticipated events, if portfolio managers could somehow predict the future movement of the market, then prices in the market would already reflect that knowledge, and so it would be impossible to profit from it.

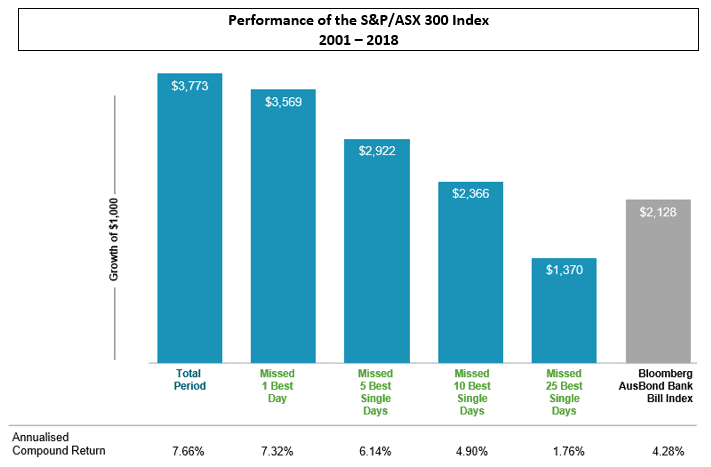

Even though there is always a danger that the market will go down tomorrow, today is the right day to start investing. The next chart shows why.

A large proportion of the long-term gain in investment in the share market comes from sharp upward bursts. Just missing a few days of strong returns since 1992 would have resulted in dramatically lower returns than staying invested throughout the period.

$1000 invested July 1, 1992, in the S&P/ASX 300 would have accumulated to $7,644 by December 31, 2013. If you missed the 25 best single days over that time period your $1000 investment would have grown only to $2,702.

1For an intelligent and entertaining discussion of this issue, see Burton R. Malkiel, A Random Walk Down Wall Street.