It was the end of 2022 and every market commentator and analyst seemed to be planning for the recession they were convinced was coming. Equities and bond yields would all tumble as the fastest interest rate increases in a generation would plunge the world into a recession. And for a while this scenario seemed to be playing out as the US regional bank crisis and the collapse of Credit Suisse indicated that recession was fast approaching.

But something else was going on – Artificial-intelligence shares were red hot and dragged up chip stocks behind them, while the so-called Magnificent 7 — Tesla, Amazon, Meta, Apple, Alphabet, Nvidia and Microsoft — dominated US equity gains. By the end of September world equity markets were up 17% (in AUD) while the global bond market looked like producing its third negative year in a row. Not what the analysts had been forecasting at all…

But then the last two months of 2023 saw a remarkable shift in sentiment from central bankers. In November data showed U.S. and European inflation falling much faster than expected, and the market now expected a “soft landing” instead of the “hard landing” that seemed certain only a few months earlier. Markets rallied on the view that the “terminal rate” for interest rate increases had been reached and a “pivot” would happen soon.

The Fed triggered fresh market excitement when it used its December meeting to say unequivocally that rate hikes were over. More telling though was the Fed’s “dot plot” which suggested three 25 bp cuts in 2024. The pivot party kicked into euphoric mode – markets priced in six quarter-point rate reductions in 2024, twice the three pencilled in by the central bank. Everything from global stocks to corporate bonds surged higher.

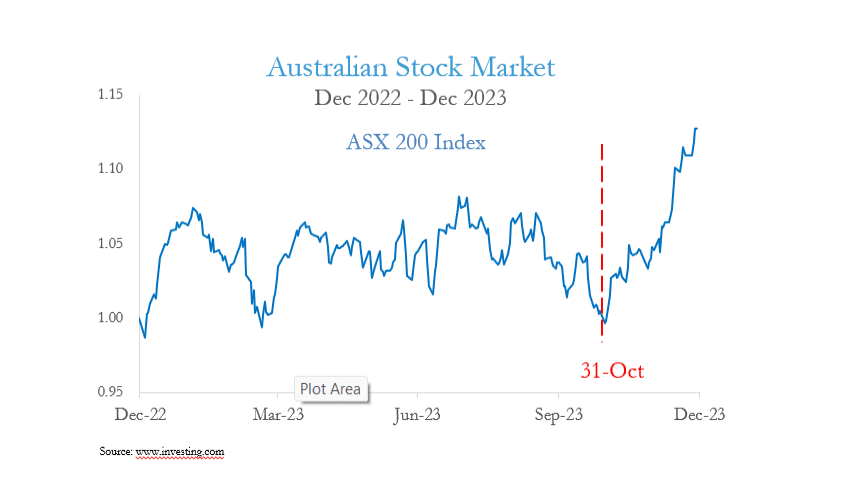

The Australian sharemarket spent most of the year in a holding pattern as concerns around where inflation would take interest rates dominated sentiment. By the end of October the market was flat for the year, and the outlook was gloomy. However, with inflation data printing lower than expected, and the Fed pivot, the ASX added a stunning 12% through November and December. Overall, the ASX is up 12.4% for the year – its best return since 2021. Most of that performance came from the last quarter, which returned 8.4%

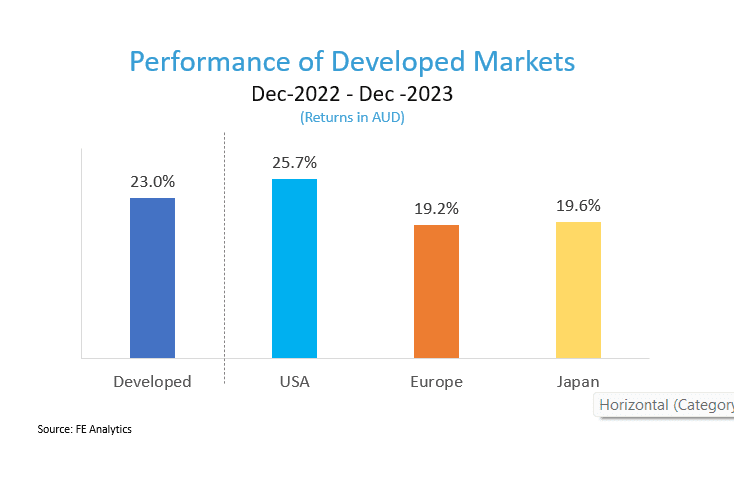

With the pivot party in full swing all sectors are booming, not just the tech stocks, and developed markets are giving some of the best returns in years. While the strong US market returns are well commented on, it may be surprising that Europe – still dealing with the Russia-Ukraine conflict – and Japan have also posted similarly strong performance for the year.

But it wasn’t just equities that have been having a good time. Australia’s listed property sector is up 16.6% just in the last quarter and is up 17.6% for the year.

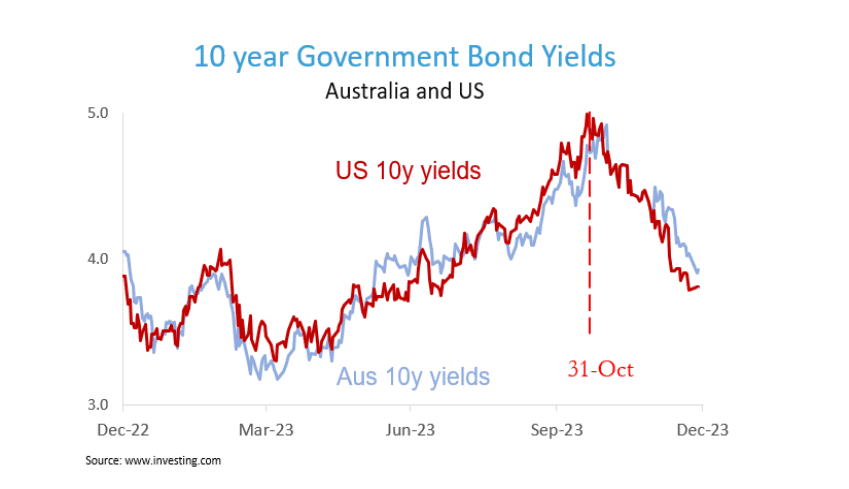

The “pivot party” has also rescued bond markets from an historic third straight year of declines. The expectation that the Feds will start cutting interest rates in 2024 has resulted in the U.S. 10-year Treasury yield, the benchmark for borrowing costs globally, dropping by more than 100 basis points (bps) since November, the biggest fall since 2008.

This means that investors in bonds have enjoyed returns superior to cash and term deposits in 2023. At the start of 2023 the average 1-year term deposit rate was 3.7%. But at the end of 2023 the Australian Composite Bond index has returned 5.1%, while the Global Aggregate Bond Index – the standard measure of the performance of global bonds hedged to Aussie dollars – has returned 5.3%.

Behind the move lower in yields has been a sustained decline in inflation around the world that has driven the expectations that central banks will cut interest rates early next year. The US economy has remained strong, feeding hopes for a “soft landing”. The last quarter of 2023 has ended on a high – but all parties must come to an end.

Can global equities keep rallying based on optimism over Fed rate cuts, or will the slowdown in the global economy end up being more severe than currently envisaged? Are we really set for a “soft landing” and is inflation truly vanquished? Could global geopolitical relations deteriorate further?

How will markets respond to those risks? The coming year will provide answers to these questions – and no doubt present new risks and opportunities. For investors, the year just gone reminds us of the benefits of staying invested and staying diversified. Trying to time markets is impossible, and as 2023 as starkly shown following market forecasts is not a good investment strategy.

Dr Steve Garth

January 15, 2024