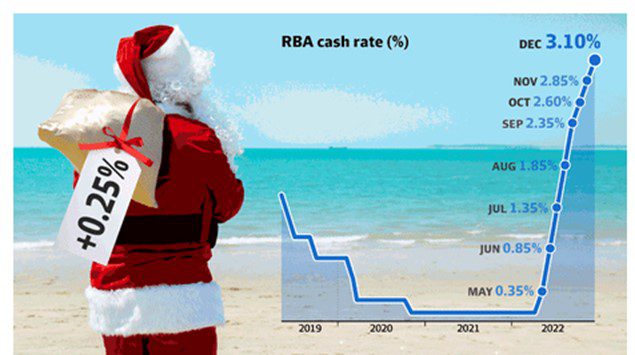

On Tuesday 6th December the Reserve Bank lifted the cash rate from 2.85 per cent to a 10-year high of 3.1 per cent, delivering the eighth hike in as many months and more pain for indebted households just weeks out from Christmas.

But the RBA won’t hike interest rates again next month as the Board always takes a break in January. The Reserve Bank Board normally meets eleven times each year, on the first Tuesday of each month, except January.

Like the rest of Australia, the Board will be no doubt enjoying the great Australian summer down the beach. As it happens, there is no better time for a break in what seems like an endless increase in rates. After lifting rates from their record low of 0.1 per cent to 3.1 per cent today over eight straight monthly meetings there has been a substantial cumulative increase in interest rates since May.

Graphic courtesy of The Australian Financial Review.

The RBA governor said after the December meeting that the “full effect of the increase in interest rates is yet to be felt in mortgage payments”, and that “household spending is expected to slow over the period ahead, although the timing and extent of this slowdown is uncertain”.

In other words, increasing rates does not have an immediate effect on household spending or in the fight to get inflation back down to levels that the Board deem appropriate – their so-called “target rate” of between 2% and 3%. Even if the RBA didn’t have January off, it seems prudent to take a break in lifting rates and wait to see what effect the existing higher rates are having on bringing inflation back down.

This is because it takes 2-3 months for RBA rate hikes to impact actual variable rate mortgage payments and then several months before this impacts spending. There are then flow on effects to jobs and business investment with feedback impacts on household which can take up to a year.

But the RBA cannot wait too long to see if the current rate is sufficient to bring inflation down to manageable levels – the great fear is that if inflation is not brought under control, then we could be in a situation of higher interest rates and continuing high inflation. This is something the RBA will do “whatever it takes” to prevent happening. Thus, it is expected the RBA will continue to increase rates in 2023, but they have explicitly stated there is no “pre-set course”.

The size and timing of future interest rate increases will continue to be determined by the incoming data and the RBA’s assessment of the outlook for inflation and the labour market. Adding to the uncertainty is the outlook for the global economy, which continues to deteriorate.

So what can we expect in 2023? According to the Finder RBA Cash Rate Survey, the majority of respondents felt rates are likely to hit their peak in either March 2023 or June 2023 with the “terminal rate” settling at either 3.6% or 3.85%. But keep in mind this is just a consensus view from different forecasters – we don’t know what the actual final rate will be.

But using this consensus view as a guide, it is likely we will see further hikes of 25 basis points set to be in February, March and most likely May or June of next year. The RBA governor has said that “The path to achieving the needed decline in inflation and achieving a soft landing for the economy remains a narrow one.”

What does this mean for investors in stocks and bonds? The consensus view for the “terminal rate” to be less than 4% (the majority of economists seem to think 3.85% is the right number) has already been priced into stock and bond prices. Of course, we don’t know what the actual terminal rate will be, or what effect that rate (and other global factors) will have on our economy, so markets will remain volatile as they quickly price in new information.

While the RBA have their month off, data will continue to roll in and shape the economic picture. While each cash rate move from here will be data dependent, it seems most likely that the RBA will have little option but to tighten further in the New Year. But the picture now suggests that the end of the tightening cycle is close, but not yet complete.

Dr Steve Garth

8-Nov-2022

Disclaimer:

Arch Talk blogs offers general advice only which means that we have not taken into account your personal or specific goals or requirements. The information and tools on this website do not in any way recommend products based on a needs analysis. This information has been prepared without taking into account your objectives, financial situation or needs and you should consider if the information is appropriate for you before making an investment decision. If you would like to receive personal advice, please use the contact us form on the website or call 02 9905 9001. All rights reserved | Australian Financial Services Licensee: AFSL # 234543 Pooledfunds Pty Ltd ABN 28073437742