We believe the value we provide as an adviser extends beyond the facts and figures surrounding investments to the intangible and difficult to quantify aspect of helping clients:

* Achieve their goals

* Co-ordinate their financial house

* Manage their emotions

* Make informed, rational decisions despite the noise from media and other external influences

To give you a sense of how important the intangible aspect of a client’s relationship is with their adviser, results from Dimensional Global Investor Study (over 19,000 global participants – more info here) consistently show that client’s top responses to the question “How do you primarily measure the value you receive from your advisor?” are the following, ordered:

* Sense of security or peace of mind

* Knowledge of my personal financial situation

* Progress towards my goals

* Investment returns

As you can see, despite it being something we know is so important, investment returns are outranked by the more personal and emotional areas of investors’ relationships with their adviser.

The article What you Pay a Financial Planner For also speaks to this intangible value in more detail.

Additionally, this short video (The Difference the Right Financial Advisor Makes | Dimensional) from Dimensional illustrates the noise of investment markets and demonstrates the difference the right financial adviser can make by:

* Looking beyond the inevitable ups and downs of the market

* Staying in your seat

* Tuning out the noise

* Managing your emotions

* The importance of a long term plan

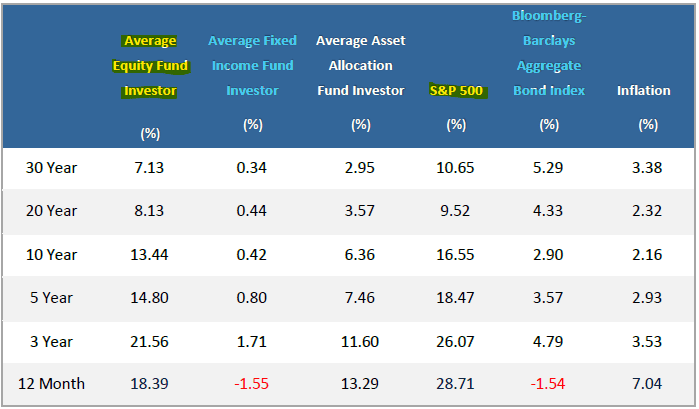

An independent research report from Dalbar 2022 QAIB Report provides more detailed and quantitative analysis on the average investors returns against the market.

In summary, both in equity (yellow) and fixed interest (blue) the average investor underperformed a simple index buy and hold strategy over the long term. What is the difference? Investors are human. Reacting to our emotions during the ups and downs of markets can significantly impact the long term investment performance achieved.

So, what is the value of financial advice?

We view our value to be linked to the successful achievement of reaching your goals and objectives and helping you navigate the financial journey along the way.